Blog

Ten Things to Know about IRS Notices and Letters

Ten Things to Know about IRS Notices and Letters

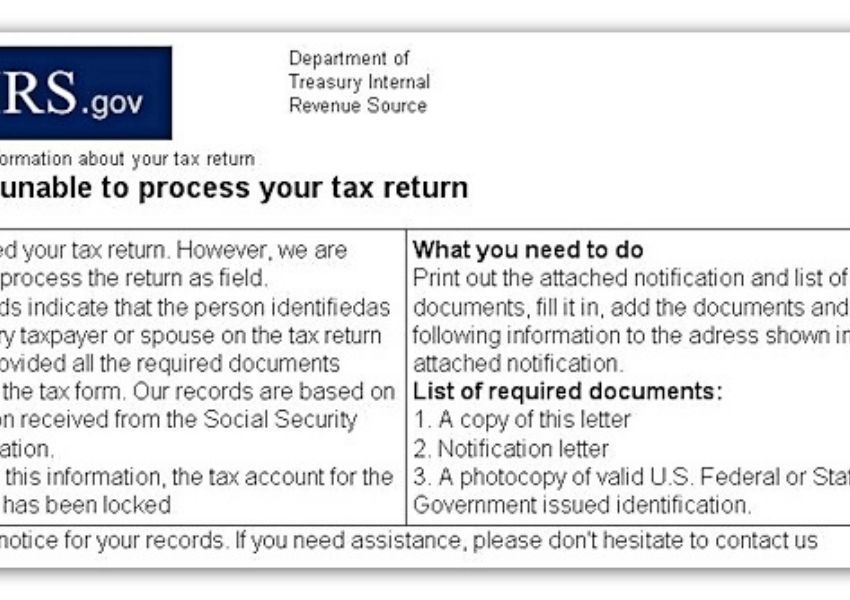

You’ve got mail! But this time it’s from the IRS. Always remember, there’s no need to press the panic button on seeing this. Each year, the IRS sends millions of notices and letters to taxpayers for a variety of reasons. And the important thing to reiterate here is that the IRS always sends letters or notices through mail. They will not reach out to you through social media or a phone call! So, beware and never give out your personal details to anyone, who poses to be from the IRS on social media or over the phone. Brenda is aware of this because she called her tax professional, when she received her IRS notice.

Here are ten things to know in case some letter or notice from the IRS shows up in your mailbox:

1. Don’t panic. You often only need to respond to take care of a notice. An IRS notice could be either bad news or good news. You never know until you read it. The IRS often will contact by mail to inform you that you have money coming back or a refund due to you, as often as they might say you owe more tax.

2. There are many reasons why the IRS may send a letter or notice. It typically is about a specific issue on your federal tax return or tax account. A notice may tell you about changes to your account or ask you for more information. It could also tell you that you must make a payment.

3. Each notice has specific instructions about what you need to do.

4. You may get a notice that states the IRS has made a change or correction to your tax return. If you do, review the information and compare it with your original return.

5. If you agree with the notice, you usually don’t need to reply unless it gives you other instructions or you need to make a payment. If you are due additional money, the notice will say so, and then you only must wait for the check in the mail. The wait time differs depending upon the reason for the change. If the IRS takes more than 90 days to pay you, you are also entitled to interest being paid to you on the refund amount.

6. If you do not agree with the notice, it’s important for you to respond. You should write a letter to explain why you disagree. Include any information and documents you want the IRS to consider. Mail your reply with the bottom tear-off portion of the notice. Send it to the address shown in the upper left-hand corner of the notice. Allow at least 30 days for a response. If you wish to have a tax professional speak or represent you, this is where you would tell the IRS who will speak for you. There is a place to list your representative’s name, address and phone number, if the IRS needs to contact them.

7. You shouldn’t have to call or visit an IRS office for most notices. If you do have questions, call the phone number in the upper right-hand corner of the notice. Have a copy of your tax return and the notice with you when you call. This will help the IRS answer your questions. If you are not comfortable speaking with the IRS, engage or hire a tax professional to speak on your behalf. Tax professionals such as Certified Public Accountants, Enrolled Agents and Attorneys do this for a living. We know what to say and how to speak to the IRS. There is no need for you, the taxpayer to stress out, and become anxious when dealing with the IRS. Let the professional handle these types of communications.

8. Keep copies of any notices you receive with your other tax records.

9. The IRS sends letters and notices by mail. They do not contact people by email or social media to ask for personal or financial information. Always be sure to send ALL correspondence to the IRS by certified mail, return receipt required.

10. For more on this topic visit https://www.IRS.gov/ or see Publication 594, The IRS Collection Process. Be sure to contact Azmoneyguy or your tax professional. DO NOT try to handle this yourself. Remember, as an old saying goes, “the attorney who represents themselves, has a fool for a client”.

Call today, don’t delay! See how this affects you. We can be reached at 602-264-9331 and on all social media under azmoneyguy.

Be more prepared for this year’s tax season! Get your copy of Bob’s NEW book, 52 Ways to Outsmart the IRS, Weekly Tax Tips to Save You Money on Amazon, Kindle, or at Azmoneyguy.com (available in paperback and eBook).

Related Blog Posts

Common Tax Filing Mistakes

Learn how to pass on more of your wealth to your heirs and pay less to the government before it's too late! Click here...Address & Map(602) 264 - 9331CLIENT PORTALAddress & Map(602) 264-9331[DISPLAY_ULTIMATE_SOCIAL_ICONS] Here we are at the April tax...

Tips about Taxable and Nontaxable Income

Learn how to pass on more of your wealth to your heirs and pay less to the government before it's too late! Click here...Address & Map(602) 264 - 9331CLIENT PORTALAddress & Map(602) 264-9331[DISPLAY_ULTIMATE_SOCIAL_ICONS] If there is an income, there...

Itemizing vs. Standard Deduction: Five Tips to Help You Choose

Learn how to pass on more of your wealth to your heirs and pay less to the government before it's too late! Click here...Address & Map(602) 264 - 9331CLIENT PORTALAddress & Map(602) 264-9331[DISPLAY_ULTIMATE_SOCIAL_ICONS] When you start planning early,...

Do You Owe The IRS?

Learn 5 Secrets The IRS Doesn't Want You To Know.

Click on the button below to get FREE access to this exclusive content.

Tax and Financial Advice from an expert

Mr. Hockensmith has been a guest newscaster for national and local TV stations in Phoenix since 1995, broadcasting financial and tax topics to the general pubic. He has written tax and accounting articles for both national and local newspapers and professional journals. He has been a public speaker nationally and locally on tax, accounting, financial planning and economics since 1992. He was a Disaster Reservist at the Federal Emergency Management Agency, for many years after his military service. He served as a Colonel with the US Army, retiring from military service after 36 years in 2008. Early in his accounting career, he was a Accountant and Consultant with Arthur Andersen CPA’s and Ernst & Young CPA’s.